- This project has passed.

Discussion — Lecture 19: Interest Rate Swaps

Perry Mehrling's Money and Banking MOOC

Start time:

October 28, 2022 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

This session covers Lecture 19: Interest Rate Swaps

NOTE: Part 4 of this lecture is missing from Perry Mehrling's site and the YouTube playlist. Here's a direct link.

Part 4: What is a Swap

This week and next week's lectures describe two important building blocks for shadow banking: interest-rate swaps (this week) and credit default swaps (next week).

The lecture works largely out of Stigum Chapter 19. Stigum defines interest-rate swaps as follows:

An interest-rate swap is a contract between two parties to pay and receive, with a set frequency, interest payments determined by applying the differential between two interest rates—for example, 5-year fixed and 6-month LIBOR—to an agreed-upon notional principal. (p. 869)

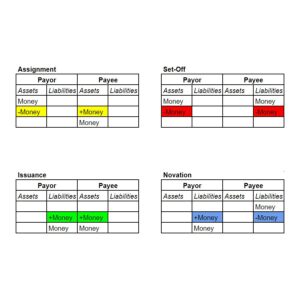

Mehrling uses the balance-sheet framework we already know to explain the mechanics of an interest-rate swap. We build incrementally on concepts we've covered so far, including repo and forward contracts. Selling an IRS is like borrowing in the repo market to finance the holding of a longer-term asset (corporate bond). But it's also like being long a portfolio of FRAs. A swap dealer is like a dealer in corporate bonds. IRS is a swap that's equivalent to borrowing long and lending short.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Jim Bramlett

alison touhey

Ádám Kerényi

Alessandro Ricchiuti

Marcela Guachamín

Celine Tcheng

Philip Jackson