- This project has passed.

Discussion — Lecture 20: Credit Default Swaps

Perry Mehrling's Money and Banking MOOC

Start time:

November 11, 2022 @ 7:00 pm - 8:00 pm

EST

Location:

Online

Type:

Other

Description

This session covers Lecture 20: Credit Default Swaps

NOTE: Part 4 of this lecture is cut short on Perry Mehrling's site and the YouTube playlist. For the full segment, watch through the Coursera site. Here's a direct link.

Part 4: What is a Credit Default Swap (CDS)?

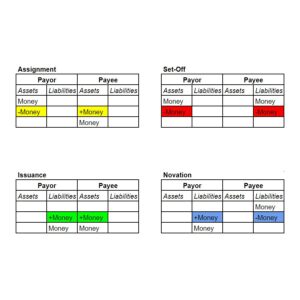

Credit default swaps (CDS) were famously implicated in the financial collapse of 2008. From our balance-sheet money-view perspective, CDS are only slightly more complicated than interest rate swaps.

Just as IRS is a swap that's equivalent to borrowing long and lending short. CDS is a swap that's equivalent to borrowing "risky" and lending "safe." You pay more interest on your notional "borrowing" than you get on your notional "lending." If the underlying risky bond defaults, you get a free Treasury. If it doesn't, then you just paid the interest-rate spread for a period of time.

Some instruments—for example, mortgage-backed-securities—that aren't normally traded on the market can still have prices imputed from the market price of CDS.

We use balance sheets to dissect three interesting cases where CDS played a role in the 2008 financial crisis.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Jim Bramlett

alison touhey

Marcela Guachamín

Juan Diego Barragan Mesa

Philip Jackson