- This project has passed.

Discussion — Lecture 21 & Reading 11: Shadow Banking

Perry Mehrling's Money and Banking MOOC

Start time:

August 7, 2023 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

This session covers Lecture 21 Shadow Banking, Central Banking, and Global Finance and Reading 11: Bagehot Was a Shadow Banker: shadow banking, Central Banking, and the Future of Global Finance by Mehrling, Pozsar, Sweeney, and Neilson (2014)

NOTE: The above link is the final published 2014 version of the paper instead of the 2013 version included in the Coursera materials.

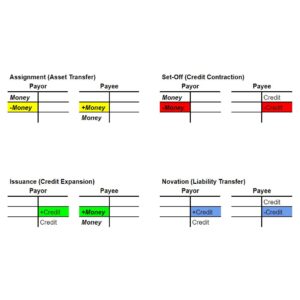

Lecture 21 asks us to imagine a stylized world in which shadow banking is the only type of banking. Shadow banking is market-based finance. All prices are market prices. Corporations (and mortgage securitizers) issue bonds onto the capital market. Derivative dealers and their swap books transfer risk away from the “shadow banks” or “capital funding banks.” These dealers are the key new feature of the modern global market-based credit system.

We then see how the Fed’s balance sheet in 2011 looks exactly how it would look if the Fed were backstopping our hypothetical pure shadow-banking system.

The paper builds on the material from the lecture. It adds a comparison to Bagehot's 19th-century gold-standard world, which we learned about in Lecture 9, Lecture 15, and the Walter Bagehot reading.

From the course website:

"The authors of this reading came together around a mutual sense that much of the existing literature and conversation was missing essential features of the emerging market-based credit system, simply because it was too bound to an old-fashioned Jimmy Stewart conception of banking. To most people, shadow banking seemed like a consequence of regulatory arbitrage, if not outright fraud, which is to say something that should never have been allowed and should now be suppressed. The Shadow Banking Colloquium started from a very different place, imagining a world in which all banking was shadow banking, and then asking how such a world would work, and how it might best be regulated. Our team included voices from banking, central banking, and academia, and we set ourselves the task of finding a simple framework that made sense to all of us, coming from our different worlds. If we could find a common language, maybe that language would also serve as a common language for others, and so it has proven to be the case."

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Daphibiang K Thangkhiew

Beatrice Mbinya

Carl Kelleher

Jorge Zaccaro

Ryan Payne