- This project has passed.

Discussion — Lecture 6: Federal Funds, Final Settlement

Perry Mehrling's Money and Banking MOOC

Start time:

May 20, 2022 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

This session covers Lecture 6: Federal Funds, Final Settlement

This lecture describes a stylized version of the US payment system, and how the Fed Funds market (interbank lending) allocated reserves among the banks before 2008 to allow them to meet their settlement constraints. It works just like Lecture 5 when the clearinghouse members borrowed from each other to be able to settle at the end of the day.

Since the 2008 crisis, there has been very little in the way of daylight overdrafts with the Fed, let alone overnight borrowing to roll over those positions. The Fed Funds market is now largely a regulatory arbitrage market. Today, the repo (repurchase agreements) market, serves largely the same purpose as Fed Funds used to, but for financial institutions that don't have direct access to the Fed's balance sheet. Perry Mehrling reminds us that "the conceptual framework remains valid."

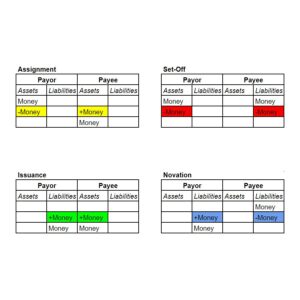

We get lots of balance-sheet practice for understanding how a credit-based payment system works. Through the lens of the Fed Funds market, we learn, among other things, about the meaning of "Real-Time Gross Settlement," the distinction between dealers and brokers, and the distinction between payments and funding. These topics will come up again and again throughout the course.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Jim Bramlett

Marta Mizsak

Özge Özay

Mark Martirosian

Tatiana Camacho

Christopher Pomwene Shafuda

Mateusz Urban

Chris Rimmer

Philip Jackson

Austin Brown

alison touhey