- This project has passed.

Discussion — Lecture 8: Eurodollars, Parallel Settlement

Perry Mehrling's Money and Banking MOOC

Start time:

June 10, 2022 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

This session covers Lecture 8: Eurodollars, Parallel Settlement

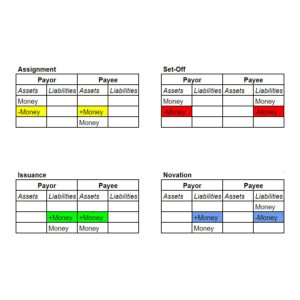

In introducing the Eurodollar market, this lecture helps us map the concept of lining up cash inflows and cash commitments (from Lecture 4) onto balance sheets. Notice that in the lecture, Mehrling tends not to record the actual cashflows on the balance sheets. Instead, he leaves them implied.

Eurodollar time deposits help us think about using balance sheets to line up cash inflows and cash commitments. The forward rate agreement (FRA) and the forward exchange contract give us some practice using implicit balance sheet arrangements to describe derivatives. The failure of the expectations hypothesis of the term structure (EH) and uncovered interest parity (UIP) presents a mystery.

Even if it looks like a complicated little derivative, it's a swap of IOUs.

Another key point from the lecture is the distinction between funding and payments. The Eurodollar market is a global funding market in the sense borrowing in the Eurodollar market is often used to fund long-lasting credit positions. This is in contrast with Fed Funds, which mostly just funded left-over payment positions that didn't collapse back down at the end of the day.

The Eurodollar market is partly about economizing domestic balance-sheet space. Doing more of your business in Eurodollars allows you to get around reserve requirements and other capital constraints. But if there's lots of extra balance-sheet space, then maybe you don't need to economize as much.

As with the Fed Funds market, the Eurodollar market has seen a big shift in recent years, again mostly being supplanted by repo. The LIBOR benchmark interest rates have been abandoned in favor of the SOFR (secured overnight funding rate).

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Jim Bramlett

Chris Rimmer

Christopher Clacio

Philip Jackson