Money and Banking 2024

Perry Mehrling's Money and Banking MOOC

Start time:

May 13 @ 2:00 pm - 3:00 pm

EDT

Location:

Online

Type:

Other

How to attend

Description

We are working through Perry Mehrling’s iconic Money and Banking MOOC. Running from May to August, we will cover two lectures and one reading per week. Many of us have taken the course before and would like to refresh our knowledge or gain a deeper understanding of the material.

Mehrling’s money view framework connects money to banking and finance by emphasizing cashflows, liquidity, hierarchical money, dealer-based markets, and market-based credit. This approach, though becoming more widely accepted, represents a departure from how money and banking had previously been taught.

Each lecture is about an hour and 15 minutes long and broken into several video segments. We meet for an hour via Zoom at 2pm EDT on Mondays to discuss the week’s lectures and on Wednesdays to discuss the reading. Further questions and discussion happen via the r/moneyview subreddit. Each lecture and reading has its own thread.

– Lecture Video Playlist

– Reddit Master Post

Schedule

- Mon May 13 — Warsaw 1: Why is Money Difficult?

- Wed May 15 — Warsaw 2: History of Money and Finance

- Mon May 20 — Lecture 1: The Four Prices of Money

- Mon May 20 — Lecture 2: The Natural Hierarchy of Money

- Wed May 22 — Reading 1: Allyn Young

- Mon May 27 — Lecture 3: Money and the State: Domestic

- Mon May 27 — Lecture 4: The Money View, Micro and Macro

- Wed May 29 — Reading 2: Hyman Minsky

- Mon June 3 — Lecture 5: The Central Bank as a Clearinghouse

- Mon June 3 — Lecture 6: Federal Funds, Final Settlement

- Wed June 5 — Reading 3: Charles Dunbar

- Mon June 10 — Lecture 7: Repos, Postponing Settlement

- Mon June 10 — Lecture 8: Eurodollars, Parallel Settlement

- Wed June 12 — Reading 4: Walter Bagehot

- Mon June 17 — Lecture 9: The World that Bagehot Knew

- Mon June 17 — Lecture 10: Dealers and Liquid Security Markets

- Wed June 19 — Reading 5: John Hicks

- Mon June 24 — Lecture 11: Banks and the Market for Liquidity

- Mon June 24 — Lecture 12: Lender/Dealer of Last Resort

- Wed June 26 — Reading 6: Jack Treynor

- Mon July 1 — Midterm Review

- Wed July 3 — Warsaw 3: Fundamentals of the Money View

- Mon July 8 — Lecture 13: Chartallism, Metallism, and Key Currencies

- Wed July 10 — Lecture 14: Money and the State: International

- Wed July 10 — Reading 7: Robert Mundell

- Mon July 15 — Lecture 15: Banks and Global Liquidity

- Mon July 15 — Lecture 16: Foreign Exchange

- Wed July 17 — Reading 8: Kindleberger

- Mon July 22 — Lecture 17: Direct and Indirect Finance

- Mon July 22 — Lecture 18: Forwards and Futures

- Wed July 24 — Reading 9: Gurley and Shaw

- Mon July 29 — Lecture 19: Interest Rate Swaps

- Mon July 29 — Lecture 20: Credit Default Swaps

- Wed July 31 — Reading 10: 1952 FOMC Report — Part 1, Part 2, Part 3

- Mon August 5 — Lecture 21: Shadow Banking, Central Banking, and Global Finance

- Mon August 5 — Reading 11: Shadow Banking*

- Wed August 7 — Lecture 22: Touching the Elephant: Three Views

- Mon August 12 — Warsaw 4: Past, Present, and Future of Shadow Banking

- Wed August 14 — Warsaw 5: Understanding Global Money

* Note: We are reading a revised version of the shadow banking paper from 2014. The earlier version from the MOOC is here.

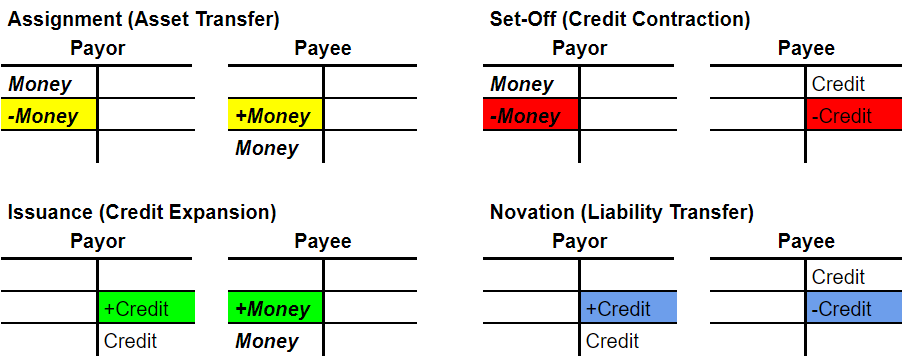

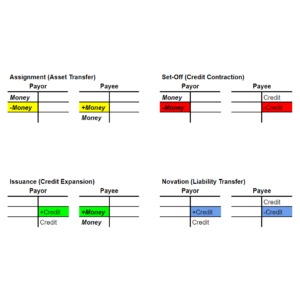

As an enhancement to the material, we are incorporating color coding for Borja Clavero’s four payment types into the balance sheets from the lectures.

– Yellow — Payment by assignment (Passing an asset to another balance sheet)

– Green — Payment by issuance (Issuing a new liability)

– Red — Payment by set-off (Canceling a liability that is owed)

– Blue — Payment by novation (Receiving a liability from another balance sheet)

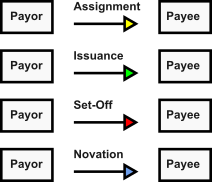

We can use color-coded arrows as a shorthand.

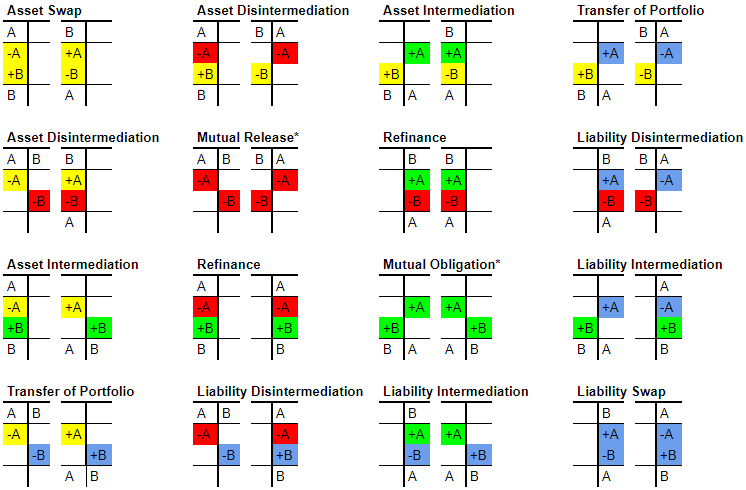

We are also using Daniel Neilson’s Quadruple Entry Accounting terminology to classify different types of transaction structures.

* Note: We’ve renamed Neilson’s Secured Loan and Repayment to Mutual Obligation and Mutual Release, respectively.

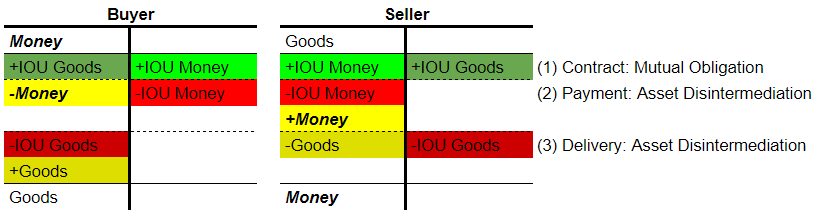

Below is a sample color-coded balance sheet based on the John Hicks Market Theory of Money reading in which Hicks divides the purchase and sale of goods into three steps.

These lectures were recorded back in 2012. The landscape of money and banking is always changing, so we may also refer to more recent material from Mehrling (and others) when appropriate.

– Perry Mehrling Papers

– Perry Mehrling Videos

– Perry Mehrling Blog

– Soon Parted Substack by Daniel Neilson

– Elham’s Money View Blog by Elham Saeidinezad

Though less recent, also of interest may be the original Money View blog by Perry Mehrling and Daniel Neilson, which ran from November 2010 to October 2012. This blog overlapped with the recording of the MOOC lectures.

Hosted by Working Group(s):

Organizers

Attendees

Gerhardt "Kiko" Kalterherberg

Engin Yilmaz

Chikumbutso Godfrey

Jeff Tonole

Pavel Branz

Jonathan Lorimer

Spencer Brown

Ramon Gimenez

Kosal Nith

Phu Nguyen

Thomas Budicin