- This project has passed.

Week 10 — Lectures 17 & 18, Reading 9

Perry Mehrling's Money and Banking MOOC

Start time:

July 22, 2021 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

We're discussing the following for week 10:

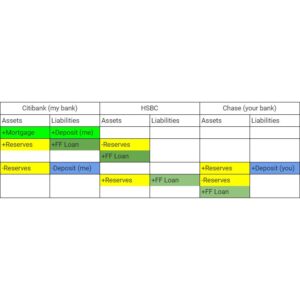

Lecture 17: Direct and Indirect Finance

Lecture Notes

Capital markets (direct finance) were once thought to be largely separate from money markets (indirect finance). But money-market funding helps give "shiftability" to capital assets, and liquidity to capital markets. In the 1930's the Fed refused to backstop the shadow banking of the day. The system was allowed to collapse.

Lecture 18: Forwards and Futures

Lecture Notes

Somewhat of a sequel to Lecture 8 about lining up the timing of cashflows. Forwards and Futures help us think about derivatives. Futures are marked to market. If a price isn't what you think it should be, someone is paying for something—often liquidity. Cash and carry arbitrage.

Reading 9: Chapter 5 of Money in a Theory of Finance by Gurley and Shaw (1960)

Study Questions

A model that emphasizes funding over payments. "Primary debt" is any debt that directly funds a real investment—direct investment. "Indirect debt" merely serves as pass-through financing for primary debt—indirect investment. For Gurley and Shaw, "inside money" is any money that directly or indirectly finances private-sector primary debt. See Lecture 17.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Win Monroe

Jennifer Judge

Bethany Burum

Ádám Kerényi

Jim Bramlett

Larissa de Lima

Alfonso Noé Martínez Alejandre

Lindsay McGrath

Ramon Gimenez

Jesus Uriegas

Chris Rimmer

Raphaele Chappe

Rok Piletic