- This project has passed.

Week 6 — Lectures 10 & 11, Reading 5

Perry Mehrling's Money and Banking MOOC

Start time:

June 24, 2021 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

We're discussing the following for week 6:

Lecture 10: Dealers and Liquid Security Markets

Lecture Notes

Introduction to the Treynor model of the economics of the dealer function. Inventories absorb order flow mismatches. Market liquidity vs. funding liquidity. Matched book vs. gross exposure. Arbitrage and brings liquidity.

Lecture 11: Banks and the Market for Liquidity

Lecture Notes

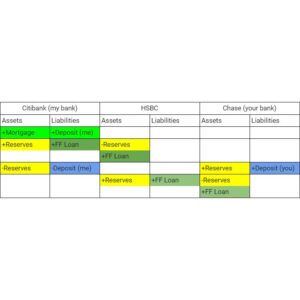

Generalize the Treynor model to banks (a.k.a. money dealers). Why is it profitable for banks to run the payment system at par when there's no bid/ask spread? How the Fed manages interest rates (floor vs. corridor system). The evolution of shadow banking.

Reading 5: Three chapters from A Market Theory of Money by John Hicks (1989)

Study Questions

Hicks reinforces some of what we've already learned in the course so far, namely that banks are a kind money dealer. But he also ties the function money to the "real" side of the economy—the market for goods and services—which Mehrling tends not to emphasize.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Win Monroe

Jennifer Judge

Bethany Burum

Ádám Kerényi

Rok Piletic

Godfrey Chipinda

Jim Bramlett

Jonah Wolf

Chris Rimmer

Ramon Gimenez

Larissa de Lima