- This project has passed.

Week 9 — Lectures 15 & 16, Reading 8

Perry Mehrling's Money and Banking MOOC

Start time:

July 15, 2021 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

We're discussing the following for week 9:

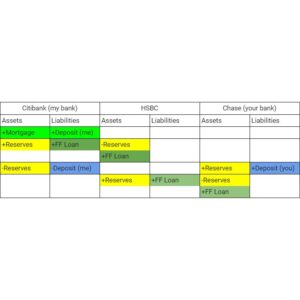

Lecture 15: Banks and Global Liquidity

Lecture Notes

Apply the Treynor model to foreign exchange in a gold-standard world, with the gold points setting the outside spread. Gold parity must hold within that narrow band or you're off the gold standard. There are important differences between internal and external drains.

Lecture 16: Foreign Exchange

Lecture Notes

Apply the Treynor model to the foreign exchange dealer market in the context of a flexible-exchange-rate system. Mehrling walks us through an example of foreign exchange market-making that tells a story of why uncovered interest parity and the expectations hypothesis fail.

Reading 8: The Dollar and World Liquidity: A Minority View by Charles Kindleberger

Kindleberger explains that in the 1960s, the US was acting as a bank to the world payment system by supplying its own dollar liabilities as liquid money and making longer-term international investments. That's not necessarily a bad thing—someone has to do it.

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Win Monroe

Jennifer Judge

Bethany Burum

Ádám Kerényi

Rok Piletic

Jim Bramlett

Chris Rimmer

Larissa de Lima

Raphaele Chappe