- This project has passed.

Discussion — Lecture 16: Foreign Exchange

Perry Mehrling's Money and Banking MOOC

Start time:

September 30, 2022 @ 6:00 pm - 7:00 pm

EDT

Location:

Online

Type:

Other

Description

This session covers Lecture 16: Foreign Exchange

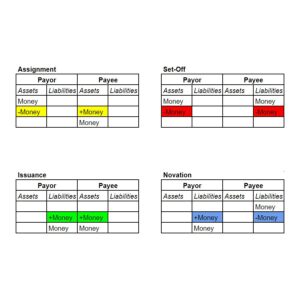

The lecture gives us a framework for reasoning about the foreign exchange dealer market in the context of a flexible-exchange-rate system. In typical money-view fashion, we look at foreign exchange market making through a lens of trading money for money, while pushing the trade of commodities and non-financial services into the background. This framework allows to tell a story about why uncovered interest parity (UIP) and the expectations hypothesis (EH) of the term structure both fail.

Lecture 16 is the most complicated lecture of the whole course. Furthermore, Mehrling's thinking on foreign exchange was still a work in progress when the lecture was filmed ten years ago. After working on it a bit more, he turned it into a paper in 2013.

Essential hybridity: a money view of FX

The paper uses the opposite exchange rate quoting convention from the lecture, and uses the term "forward interest parity" in place of "covered interest parity."

Hosted by Working Group(s):

Organizers

Attendees

Alex Howlett

Jim Bramlett

alison touhey

Heske van Doornen

Nehal Al Saied

Philip Jackson